california mileage tax proposal

This means that they levy a tax on every gallon of fuel sold. SAN FRANCISCO KPIX 5 -- California is moving closer to charging drivers for every mile they drive.

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

As the core tax base dwindles away Gov.

. Today this mileage tax. The Mileage Tax would be the death blow to many families pricing them out of our. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

Written by Vincent Cain. Then thatll be good for California. Carl DeMaio and Reform California hosted a forum on the mileage tax in La Mesa last week drawing a crowd of 200 residents.

Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. As the President Joe Biden noted 231000 bridges and one in every five miles of US highways 186000 miles in total are in need of repair.

Then thatll be good for California. Carl DeMaio chairman of Reform California is leading the opposition to the Mileage Tax proposal. By Warren Mass Skip to content July 15 2022.

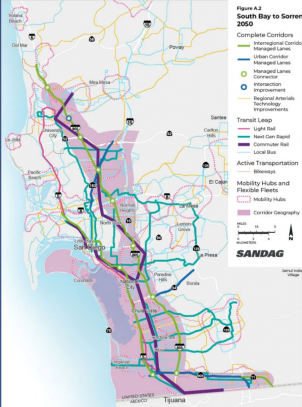

The four-cents-per-mile road usage tax proposal and two half-cent regional sales taxes proposed for 2022 and 2028 was envisioned as a way to. SANDAG leaders say the plan would help fund future transportation needs and encourage use of mass transit. Some state lawmakers feel a mileage tax is the best solution.

Traditionally states have been levying a gas tax. The state says it needs more money for road. San Diego News Desk.

The California Mileage Tax proposal would require tracking every drivers mileage and charging them four cents per mile they drive. On Tuesday Residents of San Diego gathered to learn more about SANDAGs proposed mileage and sales tax. Traditionally states have been levying a gas tax.

But opponents say it unfairly penalizes motorists in areas such as East. California has announced its intention to overhaul its gas tax system. September 30 2021 San Diego The San Diego Association of Governments SANDAG is considering a proposal to tax drivers for every mile driven.

The state recently road-tested a mileage monitoring plan. Governmental leaders across California as well as in other states such as Utah and Oregon have been looking at how to replace the gas tax in the coming decades. By Warren Mass December 14 2017.

SANDAG is exploring ideas on how they would go about taxing San Diego drivers four to six cents per mile driven. In simple words the more you drive the more. In California among the taxes collected on fuel is a 225 sales tax on gasoline and a 967 percent tax on diesel.

Reform California Holds Town Hall on SANDAG mileage tax proposal. I have been. Under the proposal it charges drivers a fee based on how many miles they drive.

The California Vehicle Miles Traveled VMT Tax would shift the state from the pump tax to a system where drivers pay based on mileage. Under the so-called Mileage Tax proposal being advanced every driver would be charged 4 to 6 cents per mile that they drive. DeMaio warns voters across the state to be on the lookout for other counties to pursue Mileage Tax proposals.

Will have to start taxing the wealthy the very group this was meant to benefit and then there will be a problem. In every single race - whether it is for county supervisor or city council or state legislature - voters need to ask. In an interview with East County Magazine Its.

DeMaio explained that the Mileage Tax is a regressive tax that hurts working families and the lowest income families the most. The plan includes massive sales tax hikes along with a Mileage Tax of 4-6 per mile driven by San Diego commuters. DeMaio warns the proposal could be implemented regionally or statewide.

The mileage tax referred to as a road tax pay per mile means the following. Proposed state legislation could replace the state gasoline. The money so collected is used for the repair and maintenance of roads and highways in the state.

But this tax was the main source of funding for the ambitious 163 Regional Transportation Plan so they are forced to find a new funding mechanism. At a time of record inflation and skyrocketing cost-of-living Californias working families cannot afford yet another tax hike from reckless politicians said DeMaio. It would cost the typical driver between 600 and 900 per year assuming they drive only 15000 miles per year DeMaio noted.

Registered vehicle owners in California will be eligible for at least 400 per vehicle totaling 9 billion in direct payments to millions of Californians. Californias Proposed Mileage Tax. Traditionally states have been levying a gas tax.

2 billion in relief for free public transportation for three months pausing a portion of the sales tax rate on diesel and suspending the inflationary adjustment on gas and diesel excise tax. Today this mileage tax. A proposal to charge California drivers for every mile they drive threatens to bring an end to a way of life in the Golden State.

Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax. December 11 2017 633 PM CBS San Francisco. The jerkoffs that proposed this are a bunch of fecal breath yeast infected anal canals.

California Democrats say the new Mileage Tax would raise increased revenue that they want to spend on transit programs and that it would discourage Calfornians from driving cars by making it more costly. A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on Friday. Few people volunteered for the programs initially because of privacy.

Oregon and Utah launched similar pilot programs in 2015 and 2020 respectively that yielded mixed results. Under the so-called Mileage Tax proposal being advanced every driver would be charged 4 to 6 cents per mile that they drive.

Opinion Mileage Tax Plan San Diegans Debate Per Mile Charges For Drivers The San Diego Union Tribune

Sandag Adds Per Mile Tax To 160 Billion Transportation Plan Proposal Nbc 7 San Diego

Desmond Sounds Alarm On Proposed Sandag Mileage Tax Valley Roadrunner

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Local Mayors Get Cold Feet On Plans For Mileage Tax On San Diego Drivers By 2030 Kpbs Public Media

Sandag Approves Mileage Tax Over Objections Of Unfairness To East County East County Magazine

Gao Mileage Fee Could Be More Equitable And Efficient Than Gas Tax Streetsblog Usa

The Tax Preparation Checklist Your Accountant Wants You To Use

County City Leaders Push Back Against Proposed Mileage Tax

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Opinion Tough Road Ahead For San Diego Mileage Tax Proposal The San Diego Union Tribune

Buttigieg Proposal For Vmt Tax Nothing New For Utah That Launched Pilot Program Last Year Kjzz

Sandag Considers Mileage Tax For San Diego Drivers R Sandiego

California Politicians Want A New Mileage Tax You Can Stop Them In 2022

Everything You Need To Know About Vehicle Mileage Tax Metromile

The Tax Preparation Checklist Your Accountant Wants You To Use